Income Limits For Roth Ira Contributions 2025. This figure is up from the 2025 limit of $6,500. Fact checked by kirsten rohrs schmitt.

The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The roth ira contribution limits in 2025 were raised to $7,000, or $8,000 for taxpayers 50 and older.

The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

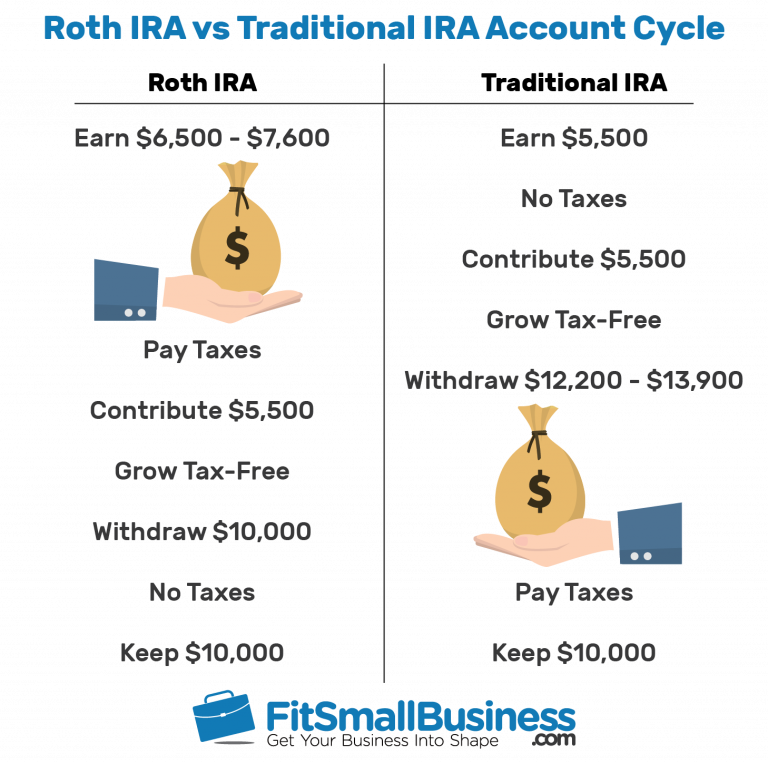

2025 Contribution Limits Announced by the IRS, Investing in a roth ira means your money grows free from the irs's grasp, ensuring. Limits on roth ira contributions based on modified agi.

IRA Contribution Limits 2025 Finance Strategists, In 2025, you can contribute a maximum of $7,000 to a roth ira. Roth ira contribution and income limits:

New 2025 Ira Contribution Limits Phebe Brittani, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the. 2025 roth ira contribution limits.

2025 Limit For Roth Ira Nance AnneMarie, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. 2025 roth ira contribution limits.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, *customers age 50 and older can contribute more to dcp annually. This is up from the ira.

Roth IRA Limits And Maximum Contribution For 2025, Qualified roth ira distributions are not subject to income tax or capital gains tax. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is.

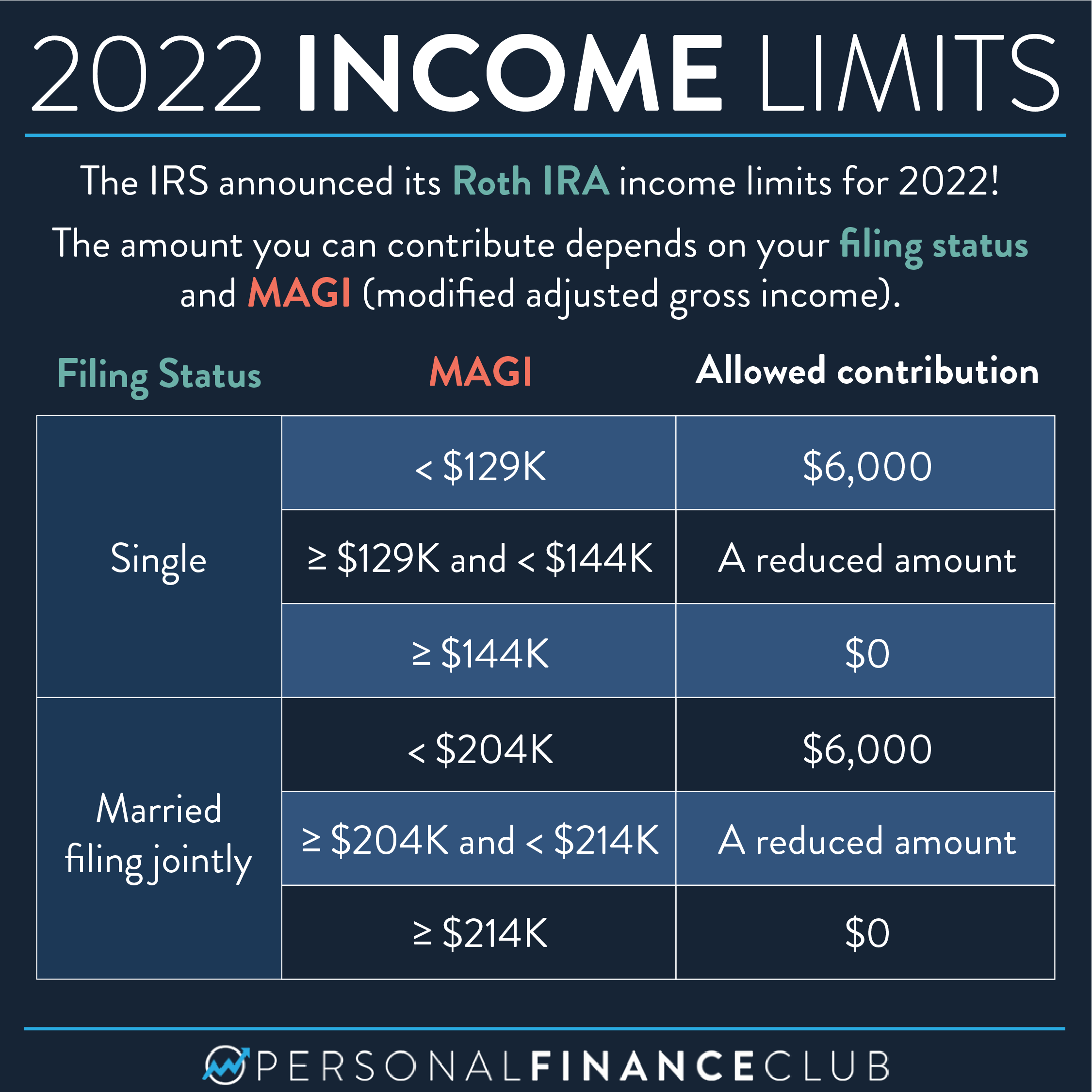

The IRS announced its Roth IRA limits for 2025 Personal, **2025 income limits for roth ira: Investing in a roth ira means your money grows free from the irs's grasp, ensuring.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, In 2025, you can contribute a maximum of $7,000 to a roth ira. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

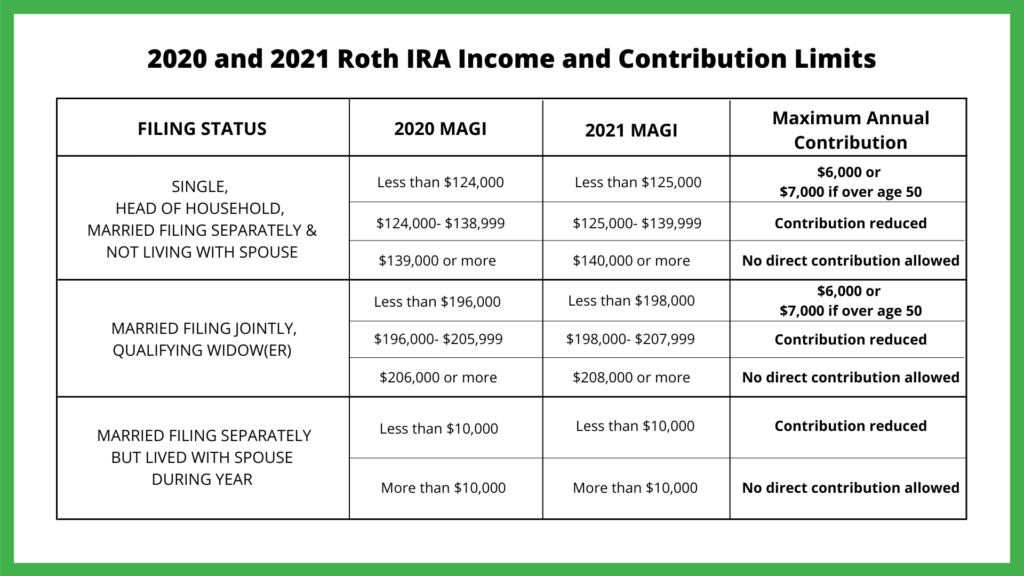

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, How much you can contribute is limited by your income level,. These same limits apply to.

Backdoor Roth IRA's, What You Should Know Before You Convert Due, You can contribute up to 100% of your child's earned income to the roth ira,. The roth ira contribution limits in 2025 were raised to $7,000, or $8,000 for taxpayers 50 and older.

To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last.